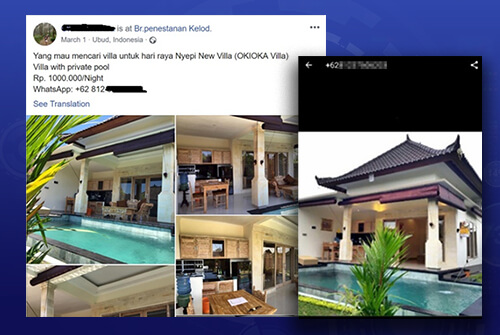

Tax authorities worldwide are struggling with the erosion of the tax base due to cross-border transactions, crypto-currencies, and the sharing economy. Market places online and advanced collaboration tools have created a boom in value creation online through the production and sale of digital goods and services. Such goods and services often exchange hands ‘under the radar’. More recent developments such as the COVID-19 pandemic may have brought the sharing economy to a halt, but have also caused a shrinking tax-base. Our solution allows tax authorities to conduct complex investigation online to identify online merchants and transactions which exclude themselves from the legal tax base.

The inherent challenges in taxation of e-commerce are anonymity, difficulty to determine the amount of tax, lack of paper trail, companies incurring liability in multiple countries, but most importantly tax authorities lack of capacity to identify companies and to manage tax liabilities. This is exacerbated by exemptions for imports of low valued goods and remote digital supplies to consumers in many jurisdictions.

Our solution supports both passive collection as well as active intelligence, as well as automatic data extraction and visualization tools to identify hidden links. With our Deep Fusion solution, these can be blended with other identifying information about tax payers to accelerate investigations and collect evidence and leads both online and offline.